Press ReleasesU S Department of the Treasury 2021-2026

IRS Guidelines for Form 8857

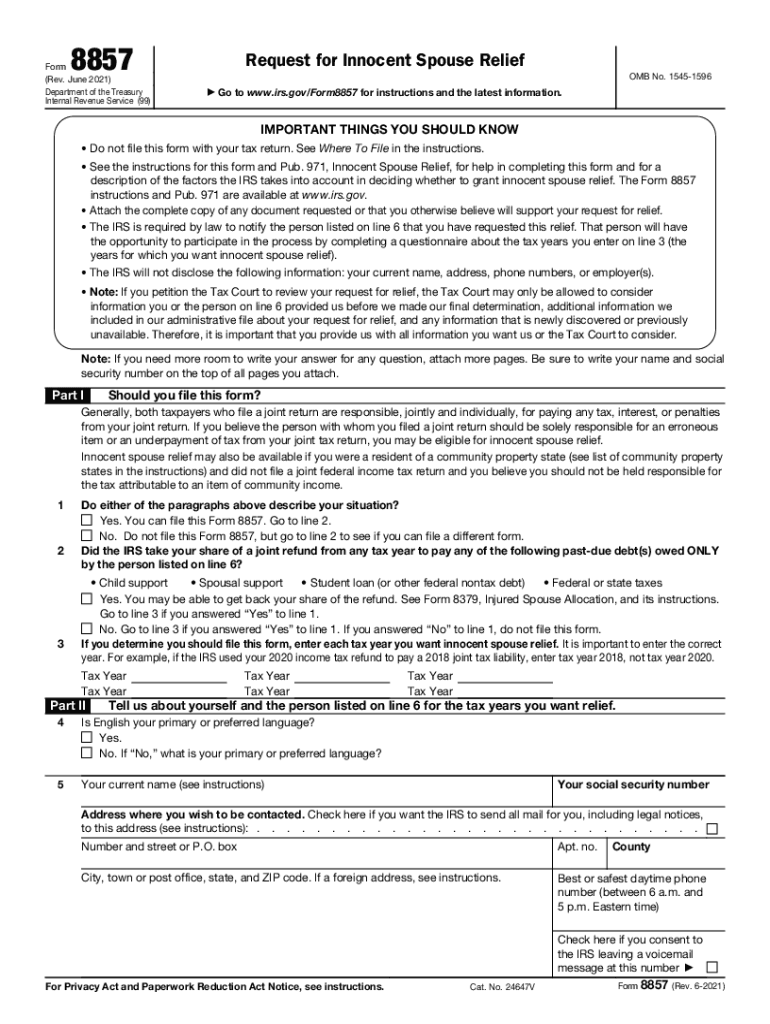

The IRS provides specific guidelines for completing the fillable 8857 form, which is essential for individuals seeking innocent spouse relief. Understanding these guidelines ensures that taxpayers accurately fill out the form, increasing the likelihood of a favorable outcome. The guidelines cover eligibility criteria, required documentation, and the process for submitting the form. It is crucial to review IRS Publication 971, which details the criteria for qualifying for innocent spouse relief, including the necessary conditions that must be met.

Steps to Complete Form 8857

Completing the fillable 8857 form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including your spouse's tax information and any relevant financial documents. Next, carefully fill out each section of the form, providing detailed explanations for your claims. It is also important to review the form for any errors or omissions before submission. Once completed, you can submit the form electronically or via mail, depending on your preference.

Eligibility Criteria for Innocent Spouse Relief

To qualify for relief under the innocent spouse provisions, certain eligibility criteria must be met. The IRS requires that you demonstrate you did not know, and had no reason to know, about the understatement of tax when you signed the joint return. Additionally, the tax owed must be attributable to your spouse's actions, not your own. Understanding these criteria is vital for ensuring that your application for relief is valid and stands a better chance of approval.

Form Submission Methods

Form 8857 can be submitted through various methods, providing flexibility for taxpayers. You can choose to file the fillable form electronically, which is often faster and allows for immediate confirmation of receipt. Alternatively, you may opt to print the completed form and mail it to the appropriate IRS address. Ensure that you check the IRS website for the latest submission guidelines and addresses to avoid any delays in processing your request.

Required Documents for Submission

When submitting Form 8857, certain documents are required to support your claim for innocent spouse relief. This may include copies of joint tax returns, any notices received from the IRS regarding tax liabilities, and documentation that demonstrates your financial situation. Providing comprehensive documentation will help substantiate your request and facilitate the review process by the IRS.

Penalties for Non-Compliance

Failing to comply with the requirements for submitting Form 8857 can result in significant penalties. If the IRS determines that the claims made in the form are not valid, you may still be held liable for the taxes owed, along with potential interest and penalties. It is essential to ensure that all information provided is accurate and truthful to avoid these consequences.

Taxpayer Scenarios for Innocent Spouse Relief

Different taxpayer scenarios may influence the outcome of an innocent spouse relief claim. For instance, if you are a stay-at-home parent who was not involved in financial decisions, you may have a stronger case for relief. Conversely, if you had access to financial information and did not act on it, your claim may be less likely to succeed. Understanding your specific situation can help tailor your application effectively.

Quick guide on how to complete press releasesus department of the treasury

Effortlessly Prepare Press ReleasesU S Department Of The Treasury on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Press ReleasesU S Department Of The Treasury on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Press ReleasesU S Department Of The Treasury with Ease

- Locate Press ReleasesU S Department Of The Treasury and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you prefer to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Alter and eSign Press ReleasesU S Department Of The Treasury to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct press releasesus department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the press releasesus department of the treasury

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a fillable 8857 form?

The fillable 8857 form is a document used for requesting innocent spouse relief from the IRS. It allows taxpayers to seek relief from additional tax liabilities that their spouse may have incurred. With airSlate SignNow, you can easily create and manage your fillable 8857 fillable forms to streamline this process.

-

How can I create a fillable 8857 fillable form using airSlate SignNow?

Creating a fillable 8857 fillable form with airSlate SignNow is simple and straightforward. You can start by uploading an existing template, then use our intuitive editing tools to add fillable fields. This ensures that your form is not only compliant but also easy to complete for all parties involved.

-

Is airSlate SignNow cost-effective for creating fillable 8857 fillable forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to create fillable 8857 fillable forms. Our pricing plans are designed to accommodate businesses of all sizes, providing excellent value with no hidden fees. You'll enjoy the benefits of increased efficiency without overspending.

-

What features does airSlate SignNow offer for fillable 8857 fillable forms?

airSlate SignNow provides a comprehensive set of features for your fillable 8857 fillable forms. These include customizable templates, eSigning capability, and secure document storage. Additionally, our platform allows for real-time collaboration, ensuring that all parties can contribute efficiently.

-

Can I track the status of my fillable 8857 fillable forms?

Absolutely! With airSlate SignNow, you can easily track the status of your fillable 8857 fillable forms. Our platform provides real-time notifications, so you’ll know when documents are viewed, signed, or need your attention. This feature enhances your workflow and keeps everything organized.

-

Does airSlate SignNow integrate with other software for fillable 8857 fillable forms?

Yes, airSlate SignNow offers seamless integrations with other popular software tools. Whether you’re using CRM systems, cloud storage, or project management applications, you can easily connect these platforms to enhance your fillable 8857 fillable forms' functionality and improve your workflow.

-

Are fillable 8857 fillable forms secure with airSlate SignNow?

AirSlate SignNow prioritizes your security while handling fillable 8857 fillable forms. Our platform uses advanced encryption and security protocols to protect your sensitive information. You can trust that your data is safe as you manage and eSign your forms confidently.

Get more for Press ReleasesU S Department Of The Treasury

- Quitclaim deed form arizona 497297053

- Arizona warranty deed for a condominium from two individuals to two individuals arizona form

- Az quitclaim form

- Arizona notice completion form

- Written statement form

- Quitclaim deed from individual to llc arizona form

- Warranty deed from individual to llc arizona form

- Quitclaim deed two 497297061 form

Find out other Press ReleasesU S Department Of The Treasury

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors